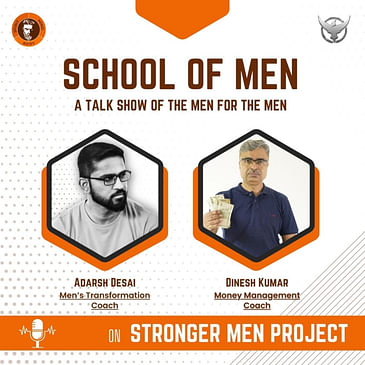

When it comes to Money matters, Money Management is the most important thing next only to earning Money. And this episode of The School Of Men is all about money management

Our guest in this episode is Dinesh Kumar, an IIT alumnus with close to 3 decades in IT sector turned Money Management Coach. He's the founder of the Mega Money Mastery Club. He helps working professionals manage money and achieve Financial Freedom

You and access all the different ways to get in touch with Dinesh on his contact page

00:00:00

Speaker 1: the mascara and welcome to the School of Men on

00:00:02

Speaker 1: the Stronger Men Project podcast. I'm your host, A. Desai,

00:00:06

Speaker 1: a mechanical engineer turned fitness coach and a gym owner.

00:00:09

Speaker 1: In the regular episodes of Stronger Men Project. I share

00:00:12

Speaker 1: my knowledge and expertise to help you lose excess body fat,

00:00:15

Speaker 1: build muscle and strength and become the fittest and the

00:00:18

Speaker 1: best looking version of yourself.

00:00:21

Speaker 1: However, this episode is a part of the School of

00:00:24

Speaker 1: Men segment, which is a biweekly talk show of the

00:00:27

Speaker 1: men and for the men where I bring experts, achievers

00:00:30

Speaker 1: and people who have inspiring stories to share and interview

00:00:34

Speaker 1: them on your behalf to share their expertise and experience

00:00:38

Speaker 1: and draw less

00:00:39

Speaker 1: for you and me to learn, grow and excel across

00:00:43

Speaker 1: different areas of our life and emerge as stronger men overall.

00:00:47

Speaker 1: Thank you for tuning in today and let's get started

00:00:49

Speaker 1: with the guest of this episode. A very, very warm

00:00:52

Speaker 1: welcome to one more brand new episode of the School

00:00:55

Speaker 1: of Men on the Stronger Men Project Podcast Today is

00:00:58

Speaker 1: a very, very important topic. This is something which I

00:01:01

Speaker 1: think will touch everybody and uh, which is very, very

00:01:04

Speaker 1: important it is about, uh, money.

00:01:07

Speaker 1: You may say that money is not the most important

00:01:10

Speaker 1: thing in life, but you have to agree to me that, uh,

00:01:12

Speaker 1: money is one of the most important things, if not

00:01:16

Speaker 1: the most important thing. And, uh, one of my online

00:01:19

Speaker 1: mentors says that, um, money may not solve all your

00:01:22

Speaker 1: problems in life, but money will solve all the money problems. And, uh,

00:01:26

Speaker 1: that is a great thing to have so that you

00:01:28

Speaker 1: can focus on other areas of your life. And, um, today,

00:01:31

Speaker 1: our guest, uh, is, um, someone who has mastered money

00:01:35

Speaker 1: and someone who is teaching money to other people. A

00:01:38

Speaker 1: good friend of mine. I would like to welcome Dinesh, uh,

00:01:41

Speaker 1: to this show. Dinesh, uh, welcome to the show. And, uh,

00:01:45

Speaker 1: why not, uh, introduce yourself. Um, what do you do?

00:01:48

Speaker 1: And a little bit about your background?

00:01:51

Speaker 2: Sure. Raj, Uh, it's a pleasure to be on your show. Uh,

00:01:55

Speaker 2: thanks for inviting me.

00:01:57

Speaker 2: And yeah, like, uh, I'm on a journey to teach

00:02:02

Speaker 2: people about money, but I won't call myself master of money.

00:02:06

Speaker 2: It's just that I have been a student of money.

00:02:09

Speaker 2: I have some learnings, uh, learnings Based on what I did, right?

00:02:14

Speaker 2: Learning based on the mistakes that I did. And I

00:02:18

Speaker 2: just want to share those learnings with other people who

00:02:21

Speaker 2: are starting on their financial journey

00:02:23

Speaker 2: so that they at least can avoid those mistakes, which

00:02:27

Speaker 2: I did. And they should be experimenting more. Uh, they

00:02:32

Speaker 2: may commit some mistakes because mistakes are where we learn

00:02:36

Speaker 2: a lot because, uh, life teaches us through the pain

00:02:40

Speaker 2: that comes out of mistakes. But if I can help

00:02:44

Speaker 2: them avoid those mistakes, which I did, um, that's my mission. Basically.

00:02:50

Speaker 2: And

00:02:51

Speaker 2: basically, I'm not a finance person. Uh, I am by

00:02:56

Speaker 2: qualification and engineer, I did my engineering firm, IT Roy, Uh,

00:03:01

Speaker 2: 91 to 95 batch. And after that, uh, going by

00:03:06

Speaker 2: the wave, I joined IT and 27 years I spent

00:03:10

Speaker 2: in IT sector. I was doing well over there,

00:03:13

Speaker 2: earning good money, and life was quite good. It's just that, uh,

00:03:18

Speaker 2: right from the beginning of my schooling, I had very

00:03:22

Speaker 2: affinity towards my teachers, And teaching was something which came

00:03:26

Speaker 2: very natural to me. I like sharing my knowledge. Whatever

00:03:30

Speaker 2: I have learned during school time, Also, I used to

00:03:33

Speaker 2: go a little advance, learn some chapters and share my

00:03:36

Speaker 2: knowledge with my fellow students. And it used to give

00:03:39

Speaker 2: me great pleasure.

00:03:41

Speaker 2: So same thing I'm trying to replicate with money. Uh,

00:03:45

Speaker 2: because money is a topic I got interested in in

00:03:48

Speaker 2: starting 2008, and I found it fascinating. I did a

00:03:52

Speaker 2: lot of learning on it and then started helping my, uh,

00:03:56

Speaker 2: fellow people who's whoever who ca I came in touch with.

00:04:00

Speaker 2: They started telling me who you are doing good.

00:04:04

Speaker 2: And 15 years later, like I felt like, why not

00:04:07

Speaker 2: take it full time? Because it was a combination of

00:04:10

Speaker 2: teaching as well as money combining those two areas I've

00:04:14

Speaker 2: started on this journey. So that's my brief introduction. And

00:04:18

Speaker 2: as we proceed, uh, you and, uh, our audience will

00:04:21

Speaker 2: get to know more about me.

00:04:23

Speaker 1: Yeah. Yeah, definitely. Dinesh. Uh uh, It is a very very,

00:04:27

Speaker 1: um um what I would say pure perspective. You are

00:04:30

Speaker 1: coming with, uh, because the aim of this is

00:04:34

Speaker 1: to, um, help men to become better. And, uh um

00:04:38

Speaker 1: you said you are not a master, but you are.

00:04:40

Speaker 1: You are a student That's a very, very beautiful thing

00:04:42

Speaker 1: you said. And, uh, everybody is on their journey of learning. And, uh,

00:04:46

Speaker 1: the goal of this podcast is to, um, draw lessons

00:04:49

Speaker 1: from you like you have been a student of money

00:04:51

Speaker 1: for some time now, and, uh, I'm, um I'm pretty

00:04:55

Speaker 1: sure all the lessons you are going to share in

00:04:58

Speaker 1: a in a few minutes will, uh, help our listeners.

00:05:01

Speaker 1: Uh, so, Dinesh, um, why don't you tell us what

00:05:04

Speaker 1: you exactly do now? Currently? What are you doing? You said,

00:05:07

Speaker 1: uh uh, why not? You said you are full time

00:05:09

Speaker 1: into teaching about money. Uh, why not share what you

00:05:12

Speaker 1: exactly do?

00:05:14

Speaker 2: Sure, Sure, I'll do that. It will be a pleasure

00:05:17

Speaker 2: to do that. So November 2022 was when I left

00:05:21

Speaker 2: my corporate job. And then I started thinking about how

00:05:25

Speaker 2: I can teach people about money. And I was since

00:05:29

Speaker 2: I have been an IT professional and I have worked

00:05:31

Speaker 2: in various MNC, SI was thinking of targeting this audience

00:05:35

Speaker 2: first

00:05:36

Speaker 2: and you Typically, when IT and MNC professionals, they start

00:05:40

Speaker 2: their career, they come to, uh, as a pleasure to

00:05:43

Speaker 2: the companies after colleges and they're given orientation. So I thought,

00:05:48

Speaker 2: Why not give a half day orientation to them and

00:05:51

Speaker 2: teach them about money also? Because now they are going

00:05:54

Speaker 2: to start earning money

00:05:55

Speaker 2: and they may end up committing some mistakes. And one

00:05:58

Speaker 2: of the typical scenarios that I thought about was towards

00:06:01

Speaker 2: the end of the financial year, typically in February March. Uh,

00:06:05

Speaker 2: an agent comes and sits in the reception of the

00:06:07

Speaker 2: office and tells people that OK, to save taxes by

00:06:11

Speaker 2: this insurance plan. And I have gone through this myself.

00:06:16

Speaker 2: And since nobody wants to pay taxes, wants to save taxes,

00:06:19

Speaker 2: we and we don't have much understanding of how to

00:06:22

Speaker 2: interpret that plan. We end up buying that plan

00:06:25

Speaker 2: and then later on, we realised Oh, my God, like,

00:06:28

Speaker 2: now I'm stuck with this plan, which is useless for me,

00:06:31

Speaker 2: not neither giving me insurance, not giving me returns. And

00:06:34

Speaker 2: that's a common scenario. I have seen happening with myself

00:06:37

Speaker 2: and with a lot of fellow, uh, in colleagues also.

00:06:42

Speaker 2: So I thought like, uh, why not target? Uh, so

00:06:45

Speaker 2: I was thinking of doing that, but infi somebody suggesting

00:06:48

Speaker 2: me that you have been in technology area for so long.

00:06:51

Speaker 2: And these days, digital is a way of reaching out

00:06:53

Speaker 2: to more people. And it made sense to me. Definitely.

00:06:56

Speaker 2: So initially the plan was to start a YouTube channel

00:06:59

Speaker 2: and and I started with that. But then I came

00:07:03

Speaker 2: across Siddharth, Siddharth, Raj, Shekhar.

00:07:06

Speaker 2: And there the idea of combining coaching and social media

00:07:11

Speaker 2: using as marketing. So it struck a chord with me

00:07:15

Speaker 2: and starting. Um, April, uh, 2023. I joined his Hackathon

00:07:21

Speaker 2: finished his hackathon. So that helped me put the basic

00:07:24

Speaker 2: systems in place. And from then onwards, like I have started, uh,

00:07:27

Speaker 2: marketing

00:07:29

Speaker 2: and brand building, putting content on social media and also

00:07:33

Speaker 2: reaching out to various people to tell about my mission.

00:07:37

Speaker 2: So that has been my journey. So far, I have

00:07:40

Speaker 2: started a community by the name of Mega Money Mastery Club,

00:07:43

Speaker 2: and as of now, seven people are part of that community,

00:07:47

Speaker 2: and I'm going to reach out to more people to

00:07:50

Speaker 2: become part of this.

00:07:52

Speaker 1: Yes, thank you, Dinesh for sharing. Um, the details. So, um,

00:07:57

Speaker 1: you said you have a community called, um

00:08:00

Speaker 1: mega money Mastery Club. Right? Um

00:08:04

Speaker 1: and you also said that, uh uh, you completely left

00:08:08

Speaker 1: your job. And, you know, you started. Uh uh, You

00:08:12

Speaker 1: know your plans to work in this field. Can you

00:08:16

Speaker 1: just tell me what prompted you to quit your job? Because, uh,

00:08:21

Speaker 1: um I know that, uh, you might have been, um,

00:08:24

Speaker 1: you know, very good. Uh, Jo, you know, very good

00:08:27

Speaker 1: job you might be earning. Really good. Since you were, uh,

00:08:30

Speaker 1: working for, uh, over two decades, Almost touching three decades.

00:08:34

Speaker 1: Yeah. Um, and you might be earning quite well. And, um,

00:08:37

Speaker 1: since you are, um uh, you know, um, you have

00:08:41

Speaker 1: mastered a little bit about managing money. Uh, your finances

00:08:45

Speaker 1: may also be very good. You might have had a

00:08:47

Speaker 1: very comfortable life, uh, going forward. But what prompted you to, um,

00:08:53

Speaker 1: you know, get out of that comfort zone and, uh,

00:08:56

Speaker 1: uh, start into this new field?

00:08:59

Speaker 2: Sure. Sure. Yeah. Uh uh. I would like to share that.

00:09:04

Speaker 2: So there is, uh, like I told you, Like, I

00:09:07

Speaker 2: had affinity towards teaching and helping others. So in between

00:09:10

Speaker 2: during my, uh, 27 years career, I tried multiple times

00:09:14

Speaker 2: getting into this. I took one or two years career

00:09:18

Speaker 2: break in between and try doing this. Uh, and I

00:09:22

Speaker 2: came back from USA in 2002 at that point of time. Also,

00:09:26

Speaker 2: 1.5 years I was trying this thing, and at that time,

00:09:29

Speaker 2: I was trying to teach,

00:09:30

Speaker 2: uh, school level students. Uh, but that was pure academic

00:09:34

Speaker 2: thing because I used to feel that I have, uh, like,

00:09:37

Speaker 2: I was academically good. I went to IT so I

00:09:40

Speaker 2: could academically help students. Uh, it didn't work out that well. Uh,

00:09:44

Speaker 2: And then, uh, around 2006, also, I tried again. And

00:09:49

Speaker 2: this time, uh, based on my experience in IBM,

00:09:52

Speaker 2: uh, I had got experience of conducting technical workshops so

00:09:56

Speaker 2: again that I had done well, I thought, like, let

00:09:59

Speaker 2: me try, uh, taking it directly to public again. It

00:10:03

Speaker 2: didn't work out that well, and finances definitely becomes a

00:10:07

Speaker 2: constraint at that point of time. So I came back

00:10:11

Speaker 2: to corporate jobs, but this was always niggling in my

00:10:14

Speaker 2: mind that I need to do something related to that

00:10:17

Speaker 2: and in my corporate jobs. Also, I try to keep

00:10:20

Speaker 2: on doing this teaching, and, uh, whenever I got an

00:10:24

Speaker 2: And now, like, uh, I have now, uh, crossed 50

00:10:29

Speaker 2: last year in December And, uh, it started, uh, hitting

00:10:33

Speaker 2: me hard that Ganesh, if you are not going to

00:10:35

Speaker 2: do it now, it's not. It's going to be never

00:10:38

Speaker 2: so if you want to do something you want to

00:10:40

Speaker 2: do and do it I, I wanted to do it

00:10:43

Speaker 2: parallel along with the job. But jobs these days are

00:10:46

Speaker 2: very demanding.

00:10:47

Speaker 2: Uh, and at senior level, it becomes even more demanding.

00:10:51

Speaker 2: So I was spending nearly 12 hours at that job,

00:10:54

Speaker 2: and after that, there was not much energy or time

00:10:57

Speaker 2: left to pursue a parallel thing. And at the end,

00:11:00

Speaker 2: companies also are not really willing that you should pursue

00:11:03

Speaker 2: something else. So I thought that if I have to

00:11:06

Speaker 2: do something which I want to do,

00:11:08

Speaker 2: and by now, like financially, uh, I felt initially when

00:11:11

Speaker 2: I started my career, OK, financial was the main thing.

00:11:14

Speaker 2: By now, I feel like even if now I can't

00:11:17

Speaker 2: build the financial question for myself, then probably I have

00:11:20

Speaker 2: no one else to blame but myself, only

00:11:23

Speaker 2: So, whatever the question is, I need to take a plunge.

00:11:26

Speaker 2: And only if I burn all my bridges, I'll be

00:11:29

Speaker 2: able to do it. So I burned all my bridges.

00:11:31

Speaker 2: And that's why I came full time into it.

00:11:34

Speaker 1: I can relate to that. Burning the bridges. That is

00:11:36

Speaker 1: what I did when I quit my job. Um, but

00:11:40

Speaker 1: what was driving you like? Uh uh, You said it was, uh,

00:11:44

Speaker 1: you know, uh, niggling in your mind that you wanted

00:11:47

Speaker 1: to do this. Uh, I would like to know why.

00:11:50

Speaker 1: Why you wanted to do this.

00:11:52

Speaker 1: Why do you want to? You said the teaching is

00:11:54

Speaker 1: your interest. And, uh, yeah, you are interested in the

00:11:58

Speaker 1: money and you choose to, you know, combine both,

00:12:02

Speaker 1: but still, the question remains Why?

00:12:06

Speaker 2: Well, uh, for me that wise enough that I want

00:12:10

Speaker 2: to create an impact in this world in one way

00:12:13

Speaker 2: or other. And these are my mediums, which I really

00:12:16

Speaker 2: resonate with. See, uh, I have been teaching people, uh,

00:12:21

Speaker 2: during my school time and even later during my corporate job, uh,

00:12:25

Speaker 2: pro bono itself because of the, uh, sharing my knowledge

00:12:30

Speaker 2: and bene if it benefits somebody,

00:12:33

Speaker 2: that itself gives me pleasure. I can do it without

00:12:35

Speaker 2: any financial consideration. Also, and even this journey, which I

00:12:39

Speaker 2: embarked on. It's not for financial consideration. It is for

00:12:43

Speaker 2: making an impact, making a something which I believe in

00:12:46

Speaker 2: because in today's world I feel that people have become

00:12:49

Speaker 2: too much obs obsessed with money. Money is important,

00:12:53

Speaker 2: but, uh, what I want to convey to people is

00:12:57

Speaker 2: that money is just a medium or a tool to

00:13:00

Speaker 2: accomplish something else. It could be, uh, better relations. It

00:13:05

Speaker 2: could be peace of mind or it could be freedom.

00:13:07

Speaker 2: Those are the bigger goals.

00:13:10

Speaker 2: Rather than focusing on these big, bigger goals, people have

00:13:13

Speaker 2: become so much obsessed with money that they have lost

00:13:16

Speaker 2: sight of these bigger goals, and at times they are

00:13:20

Speaker 2: sacrificing these bigger goals in the pursuit of money.

00:13:24

Speaker 2: So money is important for me, just as that tool

00:13:28

Speaker 2: or the medium to achieve those bigger goals. So, at

00:13:30

Speaker 2: times when some people come to me and I question them,

00:13:33

Speaker 2: why do you want more money? And if they are just, uh,

00:13:37

Speaker 2: like stuck with this thing that just for the sake

00:13:40

Speaker 2: of having more money, I don't resonate with those people

00:13:43

Speaker 2: I won't take, teach them how to make money. But

00:13:46

Speaker 2: if they have some bigger goal, I tell them, Focus

00:13:49

Speaker 2: on the bigger goal and at times you may be

00:13:51

Speaker 2: able to accomplish that bigger goal without the money itself.

00:13:54

Speaker 2: Mm. We will focus on how we can try to

00:13:58

Speaker 2: get more money to accomplish. But we shouldn't lose sight

00:14:01

Speaker 2: of those bigger goals.

00:14:03

Speaker 2: So this is message which I totally strongly feel I

00:14:06

Speaker 2: have implemented on myself and I feel like in the

00:14:11

Speaker 2: our society otherwise things have become so dry. People have

00:14:14

Speaker 2: become so obsessed with money that they are compromising their relations.

00:14:17

Speaker 2: They are compromising their health. They are compromising their peace

00:14:21

Speaker 2: of mind. In our childhood, we used to have this

00:14:24

Speaker 2: message of saying,

00:14:26

Speaker 2: uh if character is lost. Sorry If money is lost,

00:14:30

Speaker 2: nothing is lost. If health is lost, something is lost.

00:14:33

Speaker 2: And if character is lost, everything is lost

00:14:37

Speaker 2: in obsession with money. Today, people have totally reversed it.

00:14:41

Speaker 2: They say that if character is lost, nothing is lost.

00:14:44

Speaker 2: If health is lost, maybe something is lost. And if

00:14:46

Speaker 2: money is or health wealth is lost, then everything is lost.

00:14:50

Speaker 2: I want to bring it straight again. That's my mission.

00:14:54

Speaker 1: Yeah, to the issue. So in this context, since you're

00:14:57

Speaker 1: teaching about money you're teaching about how to manage money,

00:15:01

Speaker 1: how do you express to a listener the importance of, uh,

00:15:05

Speaker 1: money management?

00:15:08

Speaker 2: Yes. So a although I, uh, like, my main thing

00:15:13

Speaker 2: is to, um, but with the bigger goals. But money

00:15:17

Speaker 2: as a tool is quite important in today's world.

00:15:20

Speaker 2: Um, as you said earlier, uh, money is not everything,

00:15:24

Speaker 2: but if you don't have money, you will have be

00:15:27

Speaker 2: facing a lot of problems. And money can help you

00:15:30

Speaker 2: accomplish a lot. So I'm not undermining the importance of money.

00:15:34

Speaker 2: I fully understand the significance and importance of money, and

00:15:37

Speaker 2: I have worked on that in my own life also.

00:15:40

Speaker 2: And that's why I have chosen, uh,

00:15:43

Speaker 2: I'm trying to tap on that obsession of people. Uh,

00:15:46

Speaker 2: that OK? Yeah. Money is important. Come to me. I'll

00:15:48

Speaker 2: teach you about money, but we'll keep our focus on

00:15:51

Speaker 2: the bigger goals. That's where I'm going to direct them. So,

00:15:55

Speaker 2: um, I, I tell them, OK, money is important. Come

00:15:59

Speaker 2: to me. We'll work, uh, towards accomplishing because And if

00:16:02

Speaker 2: money is going to help that I teach you strategies,

00:16:05

Speaker 2: techniques and what mistakes to avoid while pursuing this, um,

00:16:11

Speaker 2: growing money and how to save money, How where to

00:16:14

Speaker 2: invest To get better returns and also doing the risk management. Because, uh,

00:16:20

Speaker 2: when we pursue higher returns, uh, it is that high risk,

00:16:25

Speaker 2: high return, so we have to learn to manage that risk. Also,

00:16:29

Speaker 2: a lot of people fall into this trap that they

00:16:32

Speaker 2: want high returns. They go for that. But they end

00:16:35

Speaker 2: up on the negative side of the risk, and then

00:16:39

Speaker 2: they always try to play safe, and, uh, they are

00:16:42

Speaker 2: not able to make them. So highlighting that risk, teaching

00:16:46

Speaker 2: them risk management is a very important aspect.

00:16:49

Speaker 1: Yes. OK, then So will I would like to dig

00:16:53

Speaker 1: a little deeper on the technical aspect of, uh, money management.

00:16:56

Speaker 1: But before even that, uh, I get a sense that, uh,

00:16:59

Speaker 1: you also teach about, um, the mindset towards money, that

00:17:02

Speaker 1: is the most important thing. Right. Um, So what is, uh,

00:17:06

Speaker 1: you know, what do you think is missing? Like, why

00:17:09

Speaker 1: is it important

00:17:11

Speaker 1: that, um, you know, young professionals have to learn about

00:17:15

Speaker 1: money management and what kind of mindset they have to

00:17:18

Speaker 1: develop as per you.

00:17:21

Speaker 2: So one aspect, I have already highlighted others that, uh,

00:17:25

Speaker 2: keep the bigger goals in mind. Money is not the

00:17:28

Speaker 2: bigger goal. Just, um II. I bring this thing in

00:17:32

Speaker 2: the perspective, that money is not the end goal. Um,

00:17:36

Speaker 2: one example which I share with them is that, uh

00:17:38

Speaker 2: imagine if someone is lying at her, his or her deathbed,

00:17:42

Speaker 2: and he has

00:17:43

Speaker 2: say, 100 of cars in his account. But in his life,

00:17:47

Speaker 2: he didn't had good relations. He didn't have good health.

00:17:51

Speaker 2: He didn't see the world enjoy the world. So is

00:17:55

Speaker 2: that money really worth it? On the contrary, he had

00:17:59

Speaker 2: the same deathbed. The person has this satisfaction that he

00:18:02

Speaker 2: has been able to create a positive impact in the world. Uh,

00:18:05

Speaker 2: he enjoyed a good,

00:18:07

Speaker 2: uh, life. He travelled around. He interacted well with people.

00:18:11

Speaker 2: He helped people he or she helped people. Wouldn't that

00:18:14

Speaker 2: be a better situation if he, uh, had something like

00:18:17

Speaker 2: hundreds of rupees on the account at that point of time?

00:18:20

Speaker 2: Because after the life is over, what use is that

00:18:22

Speaker 2: money going to be for him or her? So

00:18:26

Speaker 2: that way I try to put them into the perspective

00:18:28

Speaker 2: that money is of that importance a tool to uh

00:18:34

Speaker 2: so that's one aspect of mindset. I try to, uh,

00:18:37

Speaker 2: teach them after that. Uh, the other part of the

00:18:41

Speaker 2: mindset that I work with and which, uh, I also

00:18:44

Speaker 2: suffered for a long time was scarcity mindset.

00:18:48

Speaker 2: We are blessed with abundance during my own lifetime itself.

00:18:54

Speaker 2: During my childhood, even cycle was a luxury. And these

00:18:58

Speaker 2: days people have multiple cars and they still feel that, uh,

00:19:01

Speaker 2: my neighbour has BMW. I don't have BMW. He has

00:19:04

Speaker 2: two BMW SI don't have two BMW S that kind

00:19:07

Speaker 2: of thing. So there's always this scarcity mindset. Despite having

00:19:11

Speaker 2: accomplished so much, people feel that they don't have enough.

00:19:16

Speaker 2: And the only reason is that because they are comparing

00:19:18

Speaker 2: with someone who is ahead of them,

00:19:21

Speaker 2: every person's journey is unique. Every person has his own, uh,

00:19:26

Speaker 2: way or destiny. So,

00:19:30

Speaker 2: uh, uh, like developing this mindset that what I have

00:19:33

Speaker 2: is enough be happy with that. And with that positive mind,

00:19:37

Speaker 2: aspire for progress and development and growth. I don't say that.

00:19:42

Speaker 2: Don't go for two BMW S3 BMW S, maybe go

00:19:45

Speaker 2: for roll styles also go for that. But first have

00:19:48

Speaker 2: this positive mindset that whatever is there is good enough.

00:19:51

Speaker 2: Be happy with that and then aspire for progress

00:19:55

Speaker 2: with that peace of mind. And that may manifest it.

00:20:00

Speaker 2: That's another mindset, Correct. And, uh, a lot of people

00:20:04

Speaker 2: carry this negative qu, uh, beliefs about money, That money

00:20:09

Speaker 2: is evil. Money corrupts money, corrupts the relations, and rich

00:20:14

Speaker 2: people are bad or rich people are corrupt. That kind

00:20:17

Speaker 2: of thing, if people are anyone, is carrying that kind

00:20:20

Speaker 2: of belief system about money. Uh, I tell them clearly

00:20:24

Speaker 2: that money is not won't come to you because you

00:20:26

Speaker 2: yourself are telling that money is bad and do you

00:20:28

Speaker 2: want to become a bad person?

00:20:29

Speaker 2: If you don't want to become a bad person, then

00:20:31

Speaker 2: with this belief system, money is not going to come

00:20:34

Speaker 2: to you. So till this mindset is, uh, got into

00:20:39

Speaker 2: right place, uh, there's no point, uh, investing and all

00:20:44

Speaker 2: those things because even if they get the good returns,

00:20:46

Speaker 2: they will end up repelling that one.

00:20:49

Speaker 2: Yeah, true,

00:20:51

Speaker 1: I cannot help but smile when you brought up, Even

00:20:53

Speaker 1: cycle was a luxury, and I can completely relate with

00:20:57

Speaker 1: this because I had to. I got my first cycle

00:21:00

Speaker 1: when I was eight, Standard when I was like, 13

00:21:02

Speaker 1: years old. And, uh, my older boy is now seven

00:21:05

Speaker 1: years and he has already had three cycles. The younger

00:21:09

Speaker 1: one is five years old. Uh, he has had two cycles,

00:21:12

Speaker 1: one he has already lost.

00:21:13

Speaker 1: So the times have really changed. There is more and

00:21:16

Speaker 1: more abundance nowadays, like money is not in shortage nowadays.

00:21:19

Speaker 1: Money is in abundance. That is one thing I can

00:21:22

Speaker 1: relate to. And like you said about mindset, one thing is,

00:21:25

Speaker 1: um uh you go with the mindset that money is

00:21:28

Speaker 1: not the end goal, but money is the vehicle to

00:21:30

Speaker 1: a much more meaningful life. This is one thing I

00:21:32

Speaker 1: can from what you said.

00:21:35

Speaker 1: And, um, second thing is that having this abundance mindset

00:21:39

Speaker 1: and having this positive attitude towards money and especially, I think, uh,

00:21:43

Speaker 1: for our generation, um,

00:21:47

Speaker 1: maybe because of popular culture, maybe because of Bollywood, uh,

00:21:50

Speaker 1: in the nineties and 2000 was the rich guy was

00:21:54

Speaker 1: always the bad guy. And I think we have picked

00:21:57

Speaker 1: up this negative, um, mindset related to money.

00:22:01

Speaker 2: Angry young man. Angry young

00:22:03

Speaker 1: man, angry young man. And it is the case with

00:22:05

Speaker 1: all Canada film industry. Also like, it was always again

00:22:09

Speaker 1: with a always about which was the poor. And I

00:22:12

Speaker 1: think this has played a major role in terms of

00:22:15

Speaker 1: our relationship with money

00:22:16

Speaker 1: so great that you're trying to solve this problem. And, uh,

00:22:19

Speaker 1: now let's come to how are you trying to solve

00:22:22

Speaker 1: these problems? What comprises? You know, money management. What are

00:22:26

Speaker 1: the things you teach to your students in money management?

00:22:29

Speaker 1: I would like I would be interested to know.

00:22:31

Speaker 2: Sure. So the first thing, uh, I told you, mindset.

00:22:35

Speaker 2: Once the mindset is, uh, in shape, then we can

00:22:37

Speaker 2: start on working on strategies for managing money. And the

00:22:41

Speaker 2: first thing I tell people is that, uh, first, let's

00:22:45

Speaker 2: prepare the foundation. So that, uh, because if we are

00:22:48

Speaker 2: going for high risk, high growth kind of strategies, uh,

00:22:52

Speaker 2: first thing we should be able to do is if

00:22:54

Speaker 2: the risk works out on the negative side, we shouldn't

00:22:57

Speaker 2: be totally uprooted.

00:23:00

Speaker 2: Uh, we should be able to handle that risk.

00:23:02

Speaker 2: So, uh, first step is to create an emergency fund

00:23:06

Speaker 2: and emergency fund is wherein. You, uh, even if you

00:23:10

Speaker 2: lose your job, your, uh, month cash flow stops at

00:23:13

Speaker 2: least for six months to one year you are able

00:23:16

Speaker 2: to sustain. And that's for a person who is doing job,

00:23:20

Speaker 2: because the assumption is that within six months to one year,

00:23:23

Speaker 2: the person will be able to find the next job

00:23:26

Speaker 2: and resume his or her cash flow. If the person

00:23:29

Speaker 2: is in his or her own business,

00:23:31

Speaker 2: then the recommendation for emergency fund is two months of, uh,

00:23:36

Speaker 2: expenses that they should be kept in emergency fund. So

00:23:41

Speaker 2: emergency fund can't be created overnight. But I tell my

00:23:45

Speaker 2: students that, OK, start working on it and create that

00:23:48

Speaker 2: emergency fund. Uh, as soon as possible, as fast as possible.

00:23:53

Speaker 2: Then the other aspect that I, uh, bring into light is, uh,

00:23:57

Speaker 2: related to risk management is insurance,

00:24:01

Speaker 2: and when I say insurance again, people confuse or mix

00:24:06

Speaker 2: insurance with investment insurance is meant just to cover the risk.

00:24:11

Speaker 2: A risk of losing life. Uh, your family may be

00:24:14

Speaker 2: having some, uh, financial expectation from you. If you are

00:24:18

Speaker 2: not there, they are going to have emotional loss. Uh,

00:24:22

Speaker 2: that's irreparable, but even financial loss is there, which is

00:24:25

Speaker 2: quite significant. And at least that financial loss can be

00:24:28

Speaker 2: covered through that life Insurance.

00:24:31

Speaker 2: Health insurance is another thing, because these days hospitalisation has

00:24:35

Speaker 2: become so expensive. If, God forbid, somebody has to stay

00:24:39

Speaker 2: in hospital for, uh, some period of time, I have

00:24:42

Speaker 2: seen people go bankrupt. In that case, it has become

00:24:46

Speaker 2: that prohibitively expensive. And hospital won't admit you if they

00:24:50

Speaker 2: don't see your, uh, financial capability.

00:24:54

Speaker 2: So health insurance is another thing. And one thing which

00:24:58

Speaker 2: is not much talked about, is and I want to

00:25:01

Speaker 2: emphasise is disability insurance? If God forbid, uh, person, uh,

00:25:08

Speaker 2: like gets involved in an accident and he stays alive, But, uh,

00:25:13

Speaker 2: he gets disabled so his earning will stop. But he

00:25:17

Speaker 2: becomes a kind of liability because more upkeep and maintenance

00:25:20

Speaker 2: is required for this kind of person.

00:25:22

Speaker 2: So disability insurance provide that kind of cover. So more insurance, uh,

00:25:28

Speaker 2: are there to cover, uh, various kind of risk? Uh,

00:25:30

Speaker 2: there are fire insurance. There is flood insurance and all

00:25:33

Speaker 2: those kind, But at least these three insurances need to

00:25:36

Speaker 2: be in place once they are in place. A person's

00:25:39

Speaker 2: risks are get covered. And then

00:25:43

Speaker 2: a person gets confidence that even if I take some

00:25:46

Speaker 2: risk in some investment, and if the risk works out

00:25:50

Speaker 2: on the negative side, I'll be able to digest it.

00:25:52

Speaker 2: I'll be able to handle it.

00:25:55

Speaker 2: So, um because otherwise people keep a lot of money

00:25:59

Speaker 2: at less growth areas or safe area, just in the

00:26:02

Speaker 2: anticipation of, uh, some risk materialising and that money stays idle,

00:26:08

Speaker 2: it doesn't grow. Yeah, so So now that idle money

00:26:13

Speaker 2: can be freed up for investment in, uh, areas like

00:26:16

Speaker 2: stock market mutual funds and even some very high risk

00:26:20

Speaker 2: areas like Cryptocurrencies a very small portion.

00:26:23

Speaker 2: So, uh, after the insurance and risk management are in place,

00:26:27

Speaker 2: we move to towards the investment side and for investment.

00:26:30

Speaker 2: One thing which I recommend is diversification and, uh, portfolio creation.

00:26:37

Speaker 2: The reason diver diversification is so important is because, uh,

00:26:41

Speaker 2: there is a saying related to investment. Don't put all

00:26:44

Speaker 2: your eggs in one basket.

00:26:46

Speaker 2: And, uh, that's what a lot of people commit the mistake.

00:26:49

Speaker 2: Either they put every all their money in stock market,

00:26:53

Speaker 2: or they put all their money in fixed deposit or

00:26:56

Speaker 2: one common scenario, which I'm seeing is that, uh, probably

00:26:59

Speaker 2: 80 to 90% of their overall investment is in real

00:27:02

Speaker 2: estate because real estate is so expensive and big ticket

00:27:06

Speaker 2: that they end up investing so much money out there

00:27:09

Speaker 2: in real estate. Uh, but in such scenarios, like if

00:27:13

Speaker 2: one sector or one investment doesn't work out, then you

00:27:15

Speaker 2: are stuck in case of diversification. One or other investment

00:27:19

Speaker 2: will keep on working for you. And that way you

00:27:22

Speaker 2: will keep on getting consistent returns, OK,

00:27:26

Speaker 2: And then, uh, once the investment is also in place,

00:27:31

Speaker 2: then I tell them to work with

00:27:33

Speaker 2: Like, uh, all areas need to be balanced, the areas

00:27:37

Speaker 2: related to financial freedom. There should be some money allocated

00:27:42

Speaker 2: for that. There should be some money allocated for their goals,

00:27:45

Speaker 2: short term and long term goals.

00:27:48

Speaker 2: There should be some money allocated for play play. But

00:27:51

Speaker 2: when I say plays are basically, uh, it shouldn't money

00:27:54

Speaker 2: shouldn't be meant just for saving. It should also be

00:27:57

Speaker 2: like bring some joy in life for you and your family.

00:28:01

Speaker 2: So go out, uh, go out to some restaurants, go

00:28:05

Speaker 2: on some travel, uh, like, uh, see around the world

00:28:10

Speaker 2: use that money for that. So some portion, like some

00:28:13

Speaker 2: percentage of money, should be allocated. For that, Uh uh,

00:28:18

Speaker 2: some one bucket should be there for meeting the necessities. So,

00:28:22

Speaker 2: uh, I ask people to do expense tracking and see

00:28:26

Speaker 2: what's the monthly expenses. Average based monthly expenses are there.

00:28:30

Speaker 2: And create a bucket for that and take money out

00:28:32

Speaker 2: of that bucket only. And one needs to simplify his

00:28:36

Speaker 2: or her life so that expenses stay in control because

00:28:40

Speaker 2: another problem which I would like to highlight, is these

00:28:42

Speaker 2: days people are earning much, much more salaries than as

00:28:46

Speaker 2: compared to when we started our career.

00:28:47

Speaker 1: Very, very true.

00:28:49

Speaker 2: But they are still able to save lesser money as

00:28:51

Speaker 2: compared to what we used to do, because as their

00:28:54

Speaker 2: income increase, they correspondingly they increase the expenses also and

00:28:59

Speaker 2: Net net. They are still not able to save the

00:29:02

Speaker 2: money because the mindset or the equation that they follow

00:29:05

Speaker 2: is saving difficult to income minus expenses.

00:29:10

Speaker 2: But if you want to do consistent savings, then the

00:29:12

Speaker 2: equation should be expenses is equal to income minus savings.

00:29:17

Speaker 2: Yeah, that's again a mindset related thing which I I

00:29:21

Speaker 2: try to teach them beforehand. Because if person always think that, OK,

00:29:24

Speaker 2: whatever is left out of expenses, I will save then

00:29:28

Speaker 2: savings can't happen

00:29:30

Speaker 2: because there is no limit to the expenses that you

00:29:32

Speaker 2: can make in today's world, you can go in the

00:29:34

Speaker 2: negative world. Uh, also, Yeah.

00:29:38

Speaker 2: Then another thing. I, uh, teaching my community is about debt.

00:29:42

Speaker 2: People have a lot of negative mindset about debt and, uh,

00:29:46

Speaker 2: that that is bad. That is not always bad. There

00:29:50

Speaker 2: is good debt and there's bad debt.

00:29:52

Speaker 2: OK, if there is loan taken to get a liability

00:29:56

Speaker 2: when I say liability, it's something for which you are

00:29:59

Speaker 2: going to pay something like, uh, a car, maybe a

00:30:02

Speaker 2: car which is not going to be used for business purpose,

00:30:04

Speaker 2: rather for just for luxury or pleasure purpose. That's a liability.

00:30:09

Speaker 2: But a car, a loan taken for something which increases

00:30:13

Speaker 2: your value or which is going to give you returns.

00:30:15

Speaker 2: Uh, again, one has to be very mindful over here. Uh,

00:30:19

Speaker 2: because some people take house loan and then buy real estate,

00:30:25

Speaker 2: it can be done. It can be done. And because

00:30:27

Speaker 2: ho home loan is the cheapest loan that you get.

00:30:29

Speaker 2: But one has to be very mindful about this calculation

00:30:33

Speaker 2: that the asset that they're going to buy has to

00:30:35

Speaker 2: give more returns compared to what they are paying for

00:30:38

Speaker 2: the loan. That's a good asset. But if they are

00:30:41

Speaker 2: going to buy a liability from that loan like car

00:30:44

Speaker 2: or expensive gadgets or watches, then that's a bad debt.

00:30:48

Speaker 2: So debt management is another thing I teach in my

00:30:51

Speaker 1: community. Can you finish? Um uh,

00:30:55

Speaker 1: give few more examples of good debt

00:30:58

Speaker 1: for a common person who is in a job, What

00:31:00

Speaker 1: could be a good debt as per you

00:31:04

Speaker 2: home loan if done properly, uh is can be a

00:31:09

Speaker 2: good debt. And, um, buying a property using that loan

00:31:15

Speaker 2: and home loan is the cheapest loan, so typically one

00:31:18

Speaker 2: can get it for something around 8% to 9% on

00:31:22

Speaker 2: the average. And,

00:31:24

Speaker 2: uh, if one buys a property, the rental yields out

00:31:28

Speaker 2: of that could be, uh, 3 to 4%. Uh, 1

00:31:32

Speaker 2: shouldn't expect more than that, like even that I'm putting

00:31:34

Speaker 2: on the higher side, and then the if the property

00:31:38

Speaker 2: is going to appreciate, say, uh, 6 to 7% per annum.

00:31:41

Speaker 2: I'm taking that conservative estimate. Then the return from the

00:31:46

Speaker 2: property combining the rental yield and the appreciation is going

00:31:49

Speaker 2: to be 10%.

00:31:50

Speaker 2: And the loan that he's going to take is going

00:31:54

Speaker 2: to be 8 to 9%. That 1% differential is profit.

00:31:58

Speaker 2: The growth that he will get on top of that

00:32:01

Speaker 2: home loans typically bring the tax benefit also,

00:32:05

Speaker 2: so considering that this kind of thing can bring 2

00:32:09

Speaker 2: to 3% real growth because a lot of people think

00:32:13

Speaker 2: that 4 to 5% is growth is good enough. Uh,

00:32:17

Speaker 2: but inflation is an important factor to consider because in India,

00:32:22

Speaker 2: average inflation is somewhere between somewhere around 7%.

00:32:28

Speaker 2: And if one person is getting growth in portfolio or

00:32:31

Speaker 2: from investment is 4 to 5% that is not actually growth.

00:32:35

Speaker 2: That is actually the growth, because inflation is reducing the

00:32:39

Speaker 2: value of money by 7% and the growth being so

00:32:43

Speaker 2: it is a negative 2% net growth which is being achieved.

00:32:46

Speaker 2: So the growth has to be more than that inflation

00:32:50

Speaker 2: rate that is 7% to make a positive growth for, uh,

00:32:53

Speaker 2: for the person, Yeah, yeah, true.

00:32:58

Speaker 1: OK, so, um, when it comes to debt, you think, um, it's, uh,

00:33:03

Speaker 1: good to invest in, uh, good debts, which, uh, over

00:33:06

Speaker 1: a period of time will, uh, you know, keep your

00:33:09

Speaker 1: net positive, considering the interest you're paying and considering the

00:33:13

Speaker 1: returns you're getting from that and also considering inflation, Right.

00:33:17

Speaker 1: So any kind of debt you're taking you are good

00:33:20

Speaker 1: to go. If, uh, you know that, um, results in

00:33:23

Speaker 1: a net positive.

00:33:24

Speaker 1: And another thing that you said is don't go for

00:33:26

Speaker 1: bad debts. Bad debts. Could be investing in a car

00:33:29

Speaker 1: when you don't really need it. Investing in, you know,

00:33:33

Speaker 1: the latest iPhone, even if you don't need it. And nowadays,

00:33:37

Speaker 1: it is very very, uh, one.

00:33:40

Speaker 1: What I could say concerning trend for me is, uh,

00:33:44

Speaker 1: there is a lot of consumerism, like every every day.

00:33:47

Speaker 1: There is a new gadget, and, uh, there is the marketing.

00:33:51

Speaker 1: You you cannot escape the marketing, and I also go

00:33:55

Speaker 1: on to an extent to say that there is no

00:33:56

Speaker 1: free will like any action you are taking is always motivated,

00:34:00

Speaker 1: or it has been, um, somehow secreted into your mind

00:34:03

Speaker 1: through marketing and, uh, messages through different, uh, you know,

00:34:08

Speaker 1: um uh, different avenues you cannot really imagine. Like, uh,

00:34:12

Speaker 1: how it's happening if you're a normal person and not

00:34:15

Speaker 2: thinking the young generation who start their career since they

00:34:18

Speaker 2: haven't kids. And they have got, like, now, good money

00:34:21

Speaker 2: in their hand. They get easily tempted because they have

00:34:24

Speaker 2: this temptation within them. Earlier, they were getting money from

00:34:28

Speaker 2: their parents, which was kind of limited. Now, they have

00:34:30

Speaker 2: got their own money and good amount of money. They

00:34:33

Speaker 2: easily fall prey to this kind of thing. It's totally understandable. Yeah. Yeah.

00:34:37

Speaker 2: So sorry I interrupted you. You were

00:34:38

Speaker 1: like, No, it's totally fine. Um,

00:34:41

Speaker 1: uh, it was great perspective you put because I'm not

00:34:44

Speaker 1: a young person anymore. I almost forgot about that. That

00:34:46

Speaker 1: phase of life, but I would like to come back

00:34:49

Speaker 1: to it later, a little bit. But before that, um uh,

00:34:53

Speaker 1: you mentioned the term financial freedom. Can you define it for, uh,

00:34:56

Speaker 1: from your point of view, what really does it mean

00:34:59

Speaker 1: to be financially free? And then after this, we can,

00:35:02

Speaker 1: um

00:35:03

Speaker 1: um you know, talk about how will you advise a

00:35:06

Speaker 1: person who is starting in the job to, uh, you know,

00:35:10

Speaker 1: create this financial freedom and how a person who is already, like,

00:35:14

Speaker 1: 3040 years old and not in the best financial shape.

00:35:17

Speaker 1: And how would you advise that person to create this

00:35:21

Speaker 1: financial freedom?

00:35:22

Speaker 1: That will be the follow up. You can just continue

00:35:24

Speaker 1: to talk about it. Sure,

00:35:25

Speaker 2: sure. So when I say financial freedom, what I mean

00:35:29

Speaker 2: is when people, uh, especially our older generation, they could

00:35:34

Speaker 2: never think of this because they, like, uh, my father

00:35:38

Speaker 2: was born around 1947 He and, uh, from partition era.

00:35:42

Speaker 2: He had seen some very tough times.

00:35:45

Speaker 2: So money was, uh, really, like something big for, uh,

00:35:48

Speaker 2: his generation. And based on our upbringing, he kind of

00:35:52

Speaker 2: passed on that mindset to us.

00:35:55

Speaker 2: So financial freedom is a concept wherein we say that

00:35:59

Speaker 2: when someone is working to earn money, typically, the mindset

00:36:03

Speaker 2: is that I have to work and get money in return.

00:36:07

Speaker 2: So you are basically working for money.

00:36:10

Speaker 2: Mm. So it's if you're working for money. Basically, you

00:36:14

Speaker 2: are being a slave of money,

00:36:16

Speaker 2: so you can't be free.

00:36:18

Speaker 2: Financial freedom is achieved when you don't have to work

00:36:21

Speaker 2: for money.

00:36:23

Speaker 2: You rather make money, your slave, you become its master

00:36:27

Speaker 2: and you make the money work for you.

00:36:30

Speaker 2: Money works for you, and you can do whatever you want.

00:36:33

Speaker 2: You can either choose to rest, or you can choose

00:36:36

Speaker 2: to do what you want to do when that state

00:36:39

Speaker 2: is achieved. That's financial freedom.

00:36:42

Speaker 2: And

00:36:43

Speaker 2: so that's basic definition of, uh, financial freedom. High level definition. Well,

00:36:49

Speaker 2: the next question comes, How can we make it happen? Because, uh,

00:36:53

Speaker 2: people get stuck with. That's the typical mindset. Only if

00:36:56

Speaker 2: I work I will get money. What's the other way of, uh,

00:36:59

Speaker 2: getting money? So if you work for money and money

00:37:04

Speaker 2: comes to you, then it's basically active income.

00:37:08

Speaker 2: The other type of income is passive income, where you

00:37:11

Speaker 2: put some effort and put some money over there. And

00:37:15

Speaker 2: after that, it comes in the autopilot mode. You don't

00:37:18

Speaker 2: have to work on it, and it keeps on giving

00:37:20

Speaker 2: you returns. So the examples could be you write a book.

00:37:25

Speaker 2: You initially put some effort. After that, that book is published,

00:37:29

Speaker 2: and it if it is a good book, it it

00:37:31

Speaker 2: keeps getting sold and you keep on getting the royalty.

00:37:35

Speaker 2: Uh, these days, digital media, you can create courses. If

00:37:38

Speaker 2: those courses are good, people will keep on buying and

00:37:41

Speaker 2: you will keep on getting income or blogging. That could

00:37:44

Speaker 2: be another source of income. So these are passive sources

00:37:47

Speaker 2: of income where you put one time effort one time

00:37:50

Speaker 2: money and then or investments Uh, you invest in stock

00:37:55

Speaker 2: market stocks, keep on giving dividends or even, uh, bank

00:37:59

Speaker 2: related F DS. They can be so rental income, uh,

00:38:02

Speaker 2: real estate rental

00:38:04

Speaker 2: now a stage. Our expenses have to be met through

00:38:08

Speaker 2: these incomes, combination of active income and passive income. A

00:38:12

Speaker 2: stage wherein your passive income becomes so big that it

00:38:17

Speaker 2: more than covers your expenses and you don't need active income.

00:38:21

Speaker 2: You can leave your active work. Then you can say, OK,

00:38:24

Speaker 2: my passive income is going to meet my expenses. Why

00:38:27

Speaker 2: do I need to keep on, like, slogging for money?

00:38:30

Speaker 2: And that's where financial freedom is actually.

00:38:34

Speaker 1: Yeah. Wonderful. Dinesh, like one of the things, uh, over here.

00:38:38

Speaker 1: Um what message I want to give men is that

00:38:42

Speaker 1: a lot of men are stuck in a jog which

00:38:44

Speaker 1: they don't like,

00:38:46

Speaker 1: OK, this is what I used to feel when I

00:38:48

Speaker 1: was working. Um, even though it was the field which

00:38:51

Speaker 1: I like, but somehow the, you know, kind of environment

00:38:54

Speaker 1: and the kind of growth I had seen, uh, there

00:38:57

Speaker 1: are some shortfalls. There were some shortfalls from my side also,

00:39:00

Speaker 1: so that's a different story, but, uh, this is the case,

00:39:04

Speaker 1: like a lot of people. Um um

00:39:06

Speaker 1: um they have to work out of compulsion that OK,

00:39:10

Speaker 1: without working. I cannot get this money, and I cannot survive. But, uh,

00:39:15

Speaker 1: once the people, once a person achieves financial freedom, that

00:39:19

Speaker 1: means he has enough passive income. Even if he doesn't work, uh,

00:39:24

Speaker 1: he will get enough income, which, uh, which will support

00:39:27

Speaker 1: him and his family. Of course, passive income is not 100% passive.

00:39:31

Speaker 1: You have to put some effort in marketing and, you know, promoting.

00:39:35

Speaker 1: Um so it's a great concept which I never you know,

00:39:40

Speaker 1: I never knew about this. I have been introduced to

00:39:42

Speaker 1: this very, very, you know, very recently, the state

00:39:46

Speaker 2: is such that others that even people who have accumulated

00:39:50

Speaker 2: in the IT field I especially saw it because IT

00:39:53

Speaker 2: was a very rewarding field. People,

00:39:55

Speaker 2: uh, at times get overseas trip. They get rewarded well,

00:39:58

Speaker 2: in foreign currency, they create that savings and invest it

00:40:01

Speaker 2: suitable places. But the obsession with money is such that

00:40:05

Speaker 2: they still keep on working for more and more money.

00:40:07

Speaker 2: They I. I tend I have to tell people that

00:40:10

Speaker 2: you already have so much that you can be financially free.

00:40:13

Speaker 2: But that mindset is not there. That concept of understanding

00:40:17

Speaker 2: is not that, Yeah, I can be financially free.

00:40:20

Speaker 2: So that's my mission to tell people you can be

00:40:23

Speaker 2: financially free. So be financially free. Why you want to

00:40:27

Speaker 2: keep on claiming but that because of habit because of

00:40:31

Speaker 2: that mindset, Because of that conditioning, people have accepted this

00:40:34

Speaker 2: slavery as way of life.

00:40:36

Speaker 1: Yeah, yeah, yeah, it's a mindset is the biggest thing

00:40:39

Speaker 1: like it is the foundation for everything. Right,

00:40:43

Speaker 1: Ok, Dinesh. Um So, uh, let's come to, uh, two scenarios,

00:40:48

Speaker 1: like a person who is completely new, who is starting

00:40:51

Speaker 1: his starting out in his career. How would you advise

00:40:54

Speaker 1: that person to take care of his finances and how

00:40:57

Speaker 1: to build this life? Uh, you know how to build this, um,

00:41:01

Speaker 1: financial freedom. And, uh, after that, you can talk about, uh,

00:41:05

Speaker 1: a person who is, like, thirties in his thirties and

00:41:07

Speaker 1: forties who is already, um, has a lot of, you know,

00:41:10

Speaker 1: commitments and, uh,

00:41:12

Speaker 1: probably is holding some debt. So how would you, um,

00:41:15

Speaker 1: advise these two people?

00:41:18

Speaker 2: Sure. So first, let's talk about young people and young people.

00:41:24

Speaker 2: If they get this awareness about financial freedom concept,

00:41:29

Speaker 2: it can totally change their life and their further generations life. Because, uh,

00:41:34

Speaker 2: Einstein had said that compounding is the eighth wonder of

00:41:39

Speaker 2: the world. And in this compounding thing, um, this compounding

00:41:45

Speaker 2: is totally magical. Because after a certain stage in, if

00:41:48

Speaker 2: things are compounded, like they grow so fast, that, uh,

00:41:52

Speaker 2: human mind can't even conceptualise that

00:41:56

Speaker 2: so

00:41:57

Speaker 2: and for young people, time is their biggest friend.

00:42:01

Speaker 2: Yeah,

00:42:03

Speaker 2: uh, they If they start at the right time at

00:42:07

Speaker 2: the early stage, then they have time is the biggest asset.

00:42:10

Speaker 2: They don't need to take big risks. They can play

00:42:12

Speaker 2: very safe. The only equation that they need to understand

00:42:15

Speaker 2: is about that, uh, expenses is equal to income minus savings.

00:42:20

Speaker 2: First do savings, and then do the expenses

00:42:24

Speaker 2: rather than falling into the trap of income minus expenses

00:42:27

Speaker 2: that first they do expenses and then whatever. So set

00:42:31

Speaker 2: this equation. Right? Uh, I, I want them to become aware.

00:42:35

Speaker 2: And whatever income is there, it may be a good package.

00:42:38

Speaker 2: It may be not so good package. But manage your expenses.

00:42:42

Speaker 2: S first, do savings out of that and then manage

00:42:45

Speaker 2: your expenses. Simplify your lifestyle, OK, and then

00:42:50

Speaker 2: Well,

00:42:51

Speaker 1: what percentage? Uh, would you suggest people to start saving

00:42:55

Speaker 1: if they are, you know, completely new and beginning in

00:42:58

Speaker 1: the career.

00:43:00

Speaker 2: OK, that's where I can give some ballpark figures. Um, ideally,

00:43:05

Speaker 2: one should be saving 40% to 50% of their income,

00:43:10

Speaker 2: but every person situation is different. Uh, for some person, uh, expenses,

00:43:15

Speaker 2: because of his own situation may be more for some.

00:43:18

Speaker 2: He may able to able to manage with the lesser expense.

00:43:21

Speaker 2: So percentage wise, uh, I can give very thumb rule

00:43:24

Speaker 2: kind of thing, but, uh, one has to, uh, make

00:43:27

Speaker 2: decision based on his or her individual situation. But the

00:43:30

Speaker 2: thing is that even if you are able to save

00:43:32

Speaker 2: small percentage, be consistent. Being consistent is more important

00:43:36

Speaker 2: rather than doing a big saving for a few days

00:43:40

Speaker 2: and next month, failing to live up to that being

00:43:43

Speaker 2: consistent is the most important thing. OK? And then consistently

00:43:46

Speaker 2: keep on doing that, let it work. And then time

00:43:50

Speaker 2: is going to work magic for you.

00:43:52

Speaker 2: And, uh, you can be financially free. Uh, maybe, like

00:43:56

Speaker 2: in your late thirties or forties. Definitely. You can become

00:43:59

Speaker 2: financially free if you follow this formula

00:44:02

Speaker 2: and where to invest and all those things. Those are like, uh, very, uh,

00:44:06

Speaker 2: situational and need more learning. Um, I can teach them

00:44:10

Speaker 2: about in my programme.

00:44:12

Speaker 2: Now, Next comes the people who are starting a little late,

00:44:15

Speaker 2: maybe in their thirties and forties. So these people, uh,

00:44:18

Speaker 2: first of first thing is that they also need to

00:44:21

Speaker 2: become aware that fin financial freedom is possible. You don't

00:44:24

Speaker 2: have to keep on saving for money all throughout your life.

00:44:27

Speaker 2: Financial freedom first, uh, adopt this concept. Then they have

00:44:32

Speaker 2: to take more effort in making more savings because they

00:44:36

Speaker 2: have lost time and that time can't be returned. But

00:44:40

Speaker 2: now they have to start saving more and work with

00:44:43

Speaker 2: the same equation. That income minus savings is is good expenses.

00:44:47

Speaker 2: I know at this stage of thirties and forties cutting expenses,

00:44:51

Speaker 2: especially if they have got inflated earlier. Bringing them down

00:44:55

Speaker 2: is seems impossible, but it is not impossible. So they

00:45:00

Speaker 2: have to take that bitter pill, bring down their expenses,

00:45:04

Speaker 2: increase their savings

00:45:06

Speaker 2: and let those savings work in high growth areas. After

00:45:11

Speaker 2: putting the risk management in place and a little later,

00:45:15

Speaker 2: maybe not as fast as, like, young people can achieve it. Um,

00:45:19

Speaker 2: but these people can also achieve the financial freedom that

00:45:22

Speaker 1: OK, great. Dinesh. Uh, you said you have to cut expenses.

00:45:25

Speaker 1: Can you give, um, you know, a few examples, like

00:45:28

Speaker 1: where they can start cutting expenses?

00:45:31

Speaker 2: Sure. Um, one thing, uh, which I find a lot

00:45:35

Speaker 2: of people commit Mistake is when, uh, making a decision

00:45:39

Speaker 2: about buying a car, or we'll talk about other gadgets

00:45:44

Speaker 2: later for, for example, one of my students, when he

00:45:46

Speaker 2: came into my community, he was, uh, very emotional about that.

00:45:51

Speaker 2: His mother is like having some disability or because of

00:45:55

Speaker 2: old age. And he said, uh, he wants to buy

00:45:57

Speaker 2: a bigger car of the budget of 20 lacs and

00:46:00

Speaker 2: brand new car

00:46:01

Speaker 2: and his financial situation. Seeing his financial situation, I told him, No,

00:46:05

Speaker 2: you shouldn't do that. So I told him, First of all,

00:46:09

Speaker 2: you can get a decent car in lower budget and

00:46:13

Speaker 2: don't go for a brand new car.

00:46:15

Speaker 2: Rather, look for a deal, Uh, for a second car,

00:46:19

Speaker 2: which is two or three years old, because the car,

00:46:23

Speaker 2: immediately after taking out of showroom, depreciates by 20 to 30%.

00:46:27

Speaker 2: Just the showroom premium itself is 20%. Nearly so. Why

00:46:32

Speaker 2: go for that premium just because of that new car concept?

00:46:36

Speaker 2: On the contrary, based on the Internet and the information

00:46:39

Speaker 2: available these days, you can easily get a good segment

00:46:43

Speaker 2: car not much driven,

00:46:45

Speaker 2: and you can check for its safety and everything, and

00:46:48

Speaker 2: I get a good deal. I myself first committed that

00:46:52

Speaker 2: mistake of buying a big new car and like losing

00:46:55

Speaker 2: that money. And next time I corrected that mistake getting

00:46:58

Speaker 2: a good deal on the car. And, like,

00:47:01

Speaker 2: uh, I feel amazed like how much money one can

00:47:04

Speaker 2: save based on that, because it's not just the upfront

00:47:07

Speaker 2: capital expenditure that one makes in the buying the car

00:47:11

Speaker 2: insurance premium maintenance. Everything keeps on coming down. As you, uh, like,

00:47:16

Speaker 2: buy a second hand car. So that's one way, then

00:47:21

Speaker 2: getting a phone.

00:47:23

Speaker 2: Uh, wait,

00:47:25

Speaker 2: Uh, if you really feel that iPhone can help you

00:47:29

Speaker 2: and you can afford it, uh, go for it. But don't, uh,

00:47:33

Speaker 2: spend your one month salary just to get that iPhone

00:47:36

Speaker 2: or something. If you can do with, uh, lesser priced phone, uh,

00:47:40

Speaker 2: an android phone or something. Just because the iPhone is

00:47:43

Speaker 2: being touted as the best and everything, uh, it it

00:47:47

Speaker 2: is not something like, uh, which is it is going

00:47:50

Speaker 2: to become a liability. It is not an asset for you.

00:47:53

Speaker 2: So these are the kind of expenses which can be

00:47:55

Speaker 2: cut down easily

00:47:56

Speaker 1: again, I would say with the iPhone it that you

00:47:58

Speaker 1: are a victim of marketing. You have been told that

00:48:01

Speaker 1: iPhone is the best. And, uh, you should, uh, you know,

00:48:04

Speaker 1: go for it. Uh, I've seen, uh, we have to

00:48:07

Speaker 2: stop being the victim. They have to stop being the victim,

00:48:10

Speaker 2: and they have to control. They have to take charge. OK? Yeah. Uh,

00:48:14

Speaker 2: I know like it is having some, uh, premium value,

00:48:18

Speaker 2: but I will go for it when I can really

00:48:20

Speaker 2: afford

00:48:20

Speaker 1: it.

00:48:21

Speaker 1: Yeah. Dinesh, these are CO. The the couple of examples

00:48:24

Speaker 1: you took are, like, big ticket like car is something like, uh, uh,

00:48:28

Speaker 1: twice or thrice in a lifetime. Kind of, uh, you know, deal. Uh, for, uh,

00:48:33

Speaker 1: you know, middle class person iPhone is something like, once

00:48:37

Speaker 1: in two years or something. Can you point out few

00:48:40

Speaker 1: things like which we do on a daily basis, Like

00:48:43

Speaker 1: like month. It could be a monthly expenditure, or maybe

00:48:46

Speaker 1: a much more frequent thing

00:48:47

Speaker 1: where we can save a lot of money. Like, uh,

00:48:50

Speaker 1: it may seem like a small ticket, but, uh, the

00:48:52

Speaker 1: frequency is more. Can you give a few examples like

00:48:55

Speaker 1: that so that we can immediately help any listener?

00:48:59

Speaker 2: Uh, this, uh, cutting down their expenses. What I ask

00:49:02

Speaker 2: people to do is an exercise called expense tracking. So

00:49:06

Speaker 2: every day on the in the notepad, uh, paper and pen,

00:49:11

Speaker 2: using paper and pen, they should note down what all

00:49:14

Speaker 2: expenses they did every day. Because when I ask people

00:49:18

Speaker 2: their monthly expenses, they say that OK, they are earning

00:49:21

Speaker 2: one lakh per month.

00:49:23

Speaker 2: They are making 60 monthly expenses. In that case, they

00:49:27

Speaker 2: should be, uh, able to save 40 every month. But

00:49:30

Speaker 2: they are not able to save that much. They are

00:49:32

Speaker 2: saving 10 or 20. So I asked them, where did

00:49:35

Speaker 2: that 20 go? And they don't have any answer to that.

00:49:38

Speaker 2: So these things are called as leakages leakages. So because

00:49:43

Speaker 2: they don't even realise where that money is going and

00:49:47

Speaker 2: if they are able to fix that leakage,

00:49:49

Speaker 2: and the only way of doing that is doing this

00:49:51

Speaker 2: expense tracking every month and once they start doing expense,

00:49:56

Speaker 2: so every day, So they have to do expense tracking

00:49:59

Speaker 2: every day. And once they start noting down every day, uh,

00:50:03

Speaker 2: this thing and they have to note down every minute expense,

00:50:06

Speaker 2: they themselves start seeing that. Oh, I'm doing

00:50:09

Speaker 2: so much expense on this thing, and this is not

00:50:12

Speaker 2: meaningful expense. They start themselves cutting that down. I don't

00:50:16

Speaker 2: have to tell them to do, because for every person

00:50:19

Speaker 2: something is a person may be loving coffee. He may

00:50:22

Speaker 2: indulge in that a person may be having some other taste.

00:50:26

Speaker 2: He may not want to come because keeping your inner

00:50:28

Speaker 2: child happy is also important If you are despite making

00:50:32

Speaker 2: good savings, if you are not going to be happy,

00:50:34

Speaker 2: that money is useless.

00:50:36

Speaker 2: So the person, once he start, becomes aware of his

00:50:40

Speaker 2: expenses minutely, he himself will start cutting down on the

00:50:44

Speaker 2: low priority expenses.

00:50:48

Speaker 1: Great. Then, is one thing um, that came popped in

00:50:51

Speaker 1: my mind when you were saying this, uh, that, um

00:50:53

Speaker 1: uh we have to realise that nowadays spending money is

00:50:56

Speaker 1: has become very easy. Like everything is on your fingertips.

00:50:59

Speaker 1: Everything is on your phone like you may be ordering

00:51:02

Speaker 1: on swig and zomato again and again, which, you know

00:51:04

Speaker 1: the cost will add up.

00:51:06

Speaker 1: It is convenient, but the cost will really, really add up.

00:51:09

Speaker 1: Eating out there, you can use credit cards, anything and

00:51:13

Speaker 1: everything you want. You can just order it on Amazon.

00:51:16

Speaker 1: There is a lot of impulsive buying. This is one

00:51:18

Speaker 1: thing I have observed. I have also been a little

00:51:20

Speaker 1: mindful about this. I also tend to do this and

00:51:23

Speaker 1: UP I as much as it is a boon to

00:51:26

Speaker 1: the economy and people who are doing business. It is

00:51:29

Speaker 1: also ban for people who are spending right.

00:51:32

Speaker 1: It has become so easy to spend money. So the

00:51:35

Speaker 1: I think, uh, it's a great advice. Uh, Dinesh, like,

00:51:38

Speaker 1: we have to start noting down what we are where

00:51:41

Speaker 1: we are spending. And, uh, this is the habit, which, uh,

00:51:44

Speaker 1: I think which is lost in time. My mother used

00:51:46

Speaker 1: to do this very, very long time back, but nowadays, uh,

00:51:50

Speaker 1: hardly I have seen any per any person doing this,

00:51:53

Speaker 1: so

00:51:54

Speaker 1: I think it's, uh, you know, very very. It's like

00:51:57

Speaker 1: going back to basics, like whatever. Our parents. Yes, yes,

00:52:01

Speaker 1: the So I think, um uh, we are getting, you know, uh,

00:52:04

Speaker 1: I had, you know, short of time, Uh, we have,

00:52:08

Speaker 1: uh you know, you have got a lot of things.

00:52:10

Speaker 1: You have added a lot of value. Um uh, coming

00:52:14

Speaker 1: here on the podcast. Dinesh, thank you so much for

00:52:16

Speaker 1: doing it. Um, before parting away, Dinesh, Um, I would

00:52:21

Speaker 1: like to, uh, you know,

00:52:23

Speaker 1: like you to end with your final thoughts, or if

00:52:26

Speaker 1: you want to, um,

00:52:28

Speaker 1: share few lessons, like a couple of lessons. Uh, which

00:52:33

Speaker 1: people can take away Something like if the person has

00:52:35

Speaker 1: listened to this podcast till the end. It should be like, uh,

00:52:39

Speaker 1: you know, uh, hitting gold.

00:52:41

Speaker 2: OK, sure. I'll try that. Like to give that Golden Nugget.

00:52:46

Speaker 2: And it is that, uh, in our education system. We

00:52:50

Speaker 2: are given a lot of skills. Uh, we are taught

00:52:53

Speaker 2: about science, math and a lot of skills, and further,

00:52:57

Speaker 2: we may go for engineering or medicine for getting those skills.

00:53:00

Speaker 2: All those skills are meant for us to, uh, get

00:53:04

Speaker 2: engaged and start making money out of that.

00:53:07

Speaker 2: But in our education system, we are not talk about

00:53:10

Speaker 2: once that money starts coming, how to manage that money,

00:53:13

Speaker 2: and it's an important skill. I am trying to make

00:53:17

Speaker 2: it part of the education system. I'm going to work

00:53:19

Speaker 2: at the college level and school levels to provide that education.